Title

The Apprenticeship Levy is here! Get in touch if you'd like some advice and support

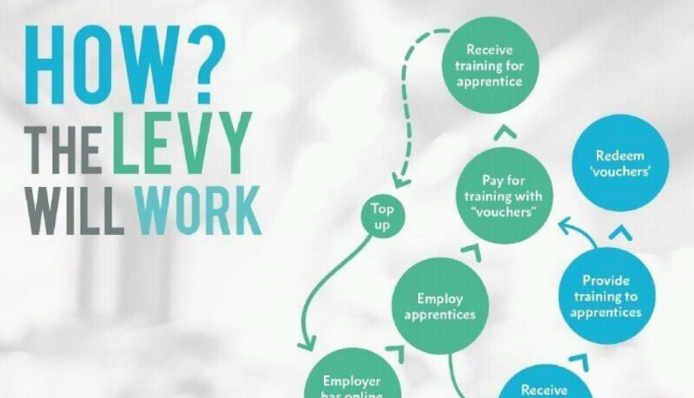

The Apprenticeship Levy comes into effect from today, 6th April. This is an amount of money that employers will pay towards the funding of Apprenticeships to help the government meet their target of 3 million Apprentices by 2020. It’s also intended to encourage increased commitment to Apprenticeships by employers, since they can use it - to fund their own Apprenticeship training – or lose it.

Every organisation with a wage bill of more than £3,000,000 will pay the Levy, which is set at 0.5% of the wage bill. It applies to all industries in the UK, including public and voluntary sector organisations such as academies and charities.

What does the Apprenticeship Levy mean for employers in Oxfordshire?

We estimate that around 400 employers in Oxfordshire will be eligible to pay the Levy. The impact on those employers will vary depending on the size of the bill and their current situation with regards employing Apprentices. For some, introduction of the Levy will mean employing an Apprentice for the first time in order to use their Levy funds. For others, it will mean expanding and developing current schemes and intoducing different types of Apprentices into the business. Some employers are looking at opportunities to utilise their Levy pot to provide training for existing staff, upskilling or retraining the current workforce.

See the FAQs page on the Oxfordshire Apprenticeships website for more on the Apprenticeship Levy.

If your organisation will be paying the Levy and you'd like some advice on how to use it, please get in touch with the OA team, who can visit you to discuss options.

What if my organisation doesn't pay the Levy?

There are changes afoot for you too! The way Apprenticeships are funded is changing from 1st May, meaning that employers who don't pay the Levy will will share the cost of training and assessing their Apprentices with the government, through ‘co-investment’. You will pay 10% towards to the cost of Apprenticeship training and the Government will pay the remaining 90%, up to a funding band maximum - the new Apprenticeship funding system will be made up of 15 funding bands, with the upper limit of those bands ranging from £1,500 to £27,000. All Apprenticeship standards and frameworks (yes there are two different types of Apprenticeship scheme!) have been placed within one of these bands. The document 'Apprenticeship Funding in England from May 2017' explains all the changes in detail.

These changes are good news for older people and those who may have been over qualified to be eligible for funding under the previous rules, since the funding is based around the nature and level of the Apprenticeship, not the individual.

The government will support employers with less than 50 employees by paying 100% of their Apprenticeship training costs for 16-18 year old Apprentices and 19-24 year old Apprentices who have been in care or have a Local Authority Education, Health and Care Plan. They are also introducing payments for all employers and training providers to meet the extra costs of employing Apprentices aged 16-18 and also those who have additional learning needs or have been in care. They will also pay for any level 1 and 2 English or maths training required by your Apprentices.

Help is at hand!

If this is all starting to sound complicated and you'd like a chat about how this will affect you, get in touch with the Oxfordshire Apprenticeships team or call 01865 323477.

Oxfordshire Apprenticeships manager Sarah Cullimore said: “We welcome the changes in the Apprenticeship funding proposals to introduce more flexibility for employers and also to provide support for younger Apprentices and those who may need some additional support. Oxfordshire Apprenticeships provide free, impartial advice for young people and their families and also employers who would like some advice about Apprenticeship funding and support with setting their own Apprenticeship scheme. If you would like more information on Apprenticeships in Oxfordshire, get in touch.”

Latest Vacancies

Ambassadors

See All Ambassadors